Case

The Funding Doctor was looking to turn their start-up idea into reality.

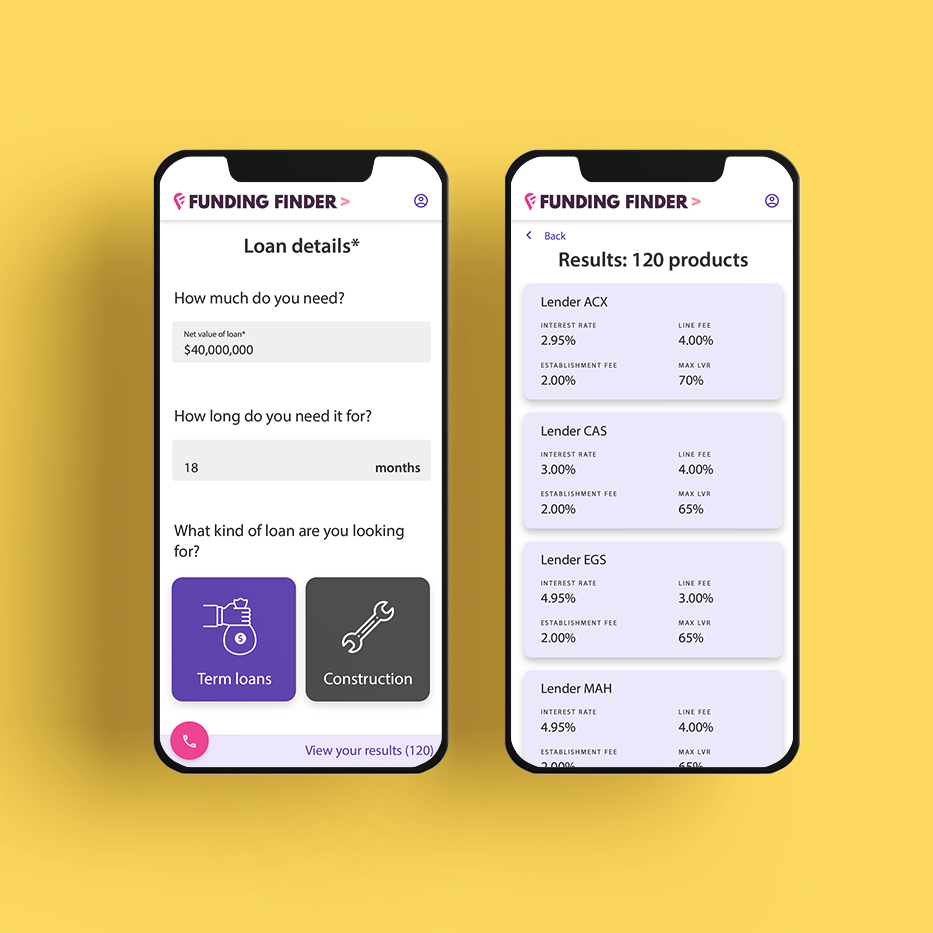

The first goal was to build a tool that would provide borrowers the most comprehensive listing of lenders and their offerings for short term finance, property finance and commercial loans as well as submit their loan application form.

The second goal was to build a dashboard that brokers could access to manage their deals.

Client

The Funding Doctor

Industry

Financial services

Services

Web application development

Market research

UX design

UI design

Technical listing

VueJS

NodeJS

Jest

Docker

Google cloud platform

Postgres

Loan application

Challenge

Solution

Loan submission, approval and settlement process is a process that involves massive paperwork, complexity and waiting periods.

The loan process for a broker encompasses multiple steps — gathering information and documents from the borrower (the client); preparing the loan submission; submitting information and data to lender(s); requesting and supply the correct supporting documents to the lender; tracking the loan through to unconditional approval and settlement; settling the loan and managing the client relationship moving forward.

For the borrower, completing a lengthy form and providing a complete set of information is a stressful step to getting the loan they want.

The Funding Doctor’s vision is to steamline this workflow for brokers by reducing the hours taken to process a loan; provide a platform that spits out information of products available in the market which are specifically suited to a borrower’s borrowing capacity; and to introduce a user friendly loan application process that comes with incentives to encourage the completion of the form.

Constant Consulting facilitated a kick-off with The Funding Doctor to unpack business requirements and ideas. We defined key user problems, needs and hypothesis of the Funding Finder. A research and analysis on competitors was also carried out to identify the platform's key differentiator that would drive it's success.

The MVP of the Funding Finder tool was designed, developed and launched within three months and under budget. The tool allows borrowers to research loan offerings and see what’s actually available in the market, and then apply directly online through a form that works intuitively on both mobile and desktop screens.

Fees get discounted if the borrower inputs all relevant information and completes the loan application. Based on the information the borrower provides, Funding Finder uses a computer algorithm to match the borrower with the lending products that are available for their project or loan type.

Lastly, a broker dashboard was designed with the brokers in mind, assisting them in sourcing deals, managing clients, researching products, and reviewing the borrower’s application form.. The broker dashboard provides a clear, real-time picture of deal status so that brokers can understand when their client would get funded and when they might get paid.